Tableaux Wealth Insights

Guidance, views, and commentary to help you make better financial decisions.

Creating a Nest Egg Before Leaving the Roost

We all know that the sooner in your career you start investing for retirement, the better. But what’s better still? Saving money before even beginning a career.

Don’t Get Kicked by the K-Shaped Economy

Billionaires are wealthier than they’ve ever been, while average people are feeling generally lousy about their financial situation. That’s the K-Shaped economy. But there’s a cure for the K-Shaped blues: own the assets.

Gold Prices Gone Bananas

The many factors still driving up the price of gold are still in force, whether the price of gold is at an all-time high or whether it has just declined by 10 percent in a matter of hours. The question is, does gold still belong in diversified portfolios?

Stop Me Before I Open Another Account

I’m just as guilty as anyone else of having too many accounts. But a bloat of accounts—credit cards, bank accounts, loans, brokerage and retirement accounts—makes it very hard to get a clear picture of your finances. So allow me to make a brief pitch for simplifying your financial life.

Fourth-Quarter 2025 Report

Risk is always top of mind for us as we think about managing portfolios, but in this update, we wanted to discuss one principle of how we implement risk management in your portfolios. We actively manage risk in portfolios with measured, incremental changes. Here’s how some of our recent portfolio decisions played out in 2025.

Right Answer, Best Answer: Why Good Financial Decisions Go Beyond Just Numbers

Is there such a thing as “the right answer” in personal finance? Maybe. But “the right answer for you” may be much more important.

You’re Invited: Tableaux Wealth Open House

It’s not our client appreciation event (that’ll be in May), but we’re hosting our first open house in our new 80 Maple Ave location—and you’re invited…

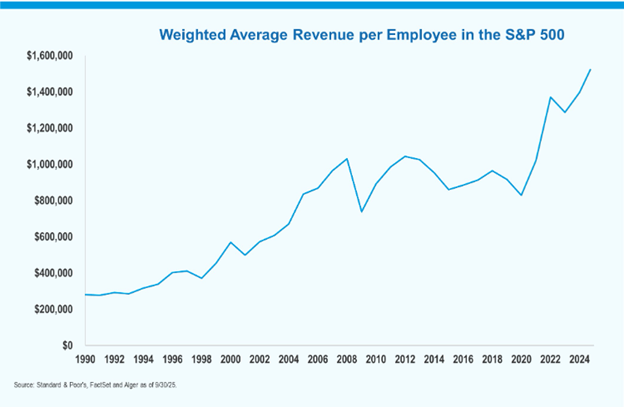

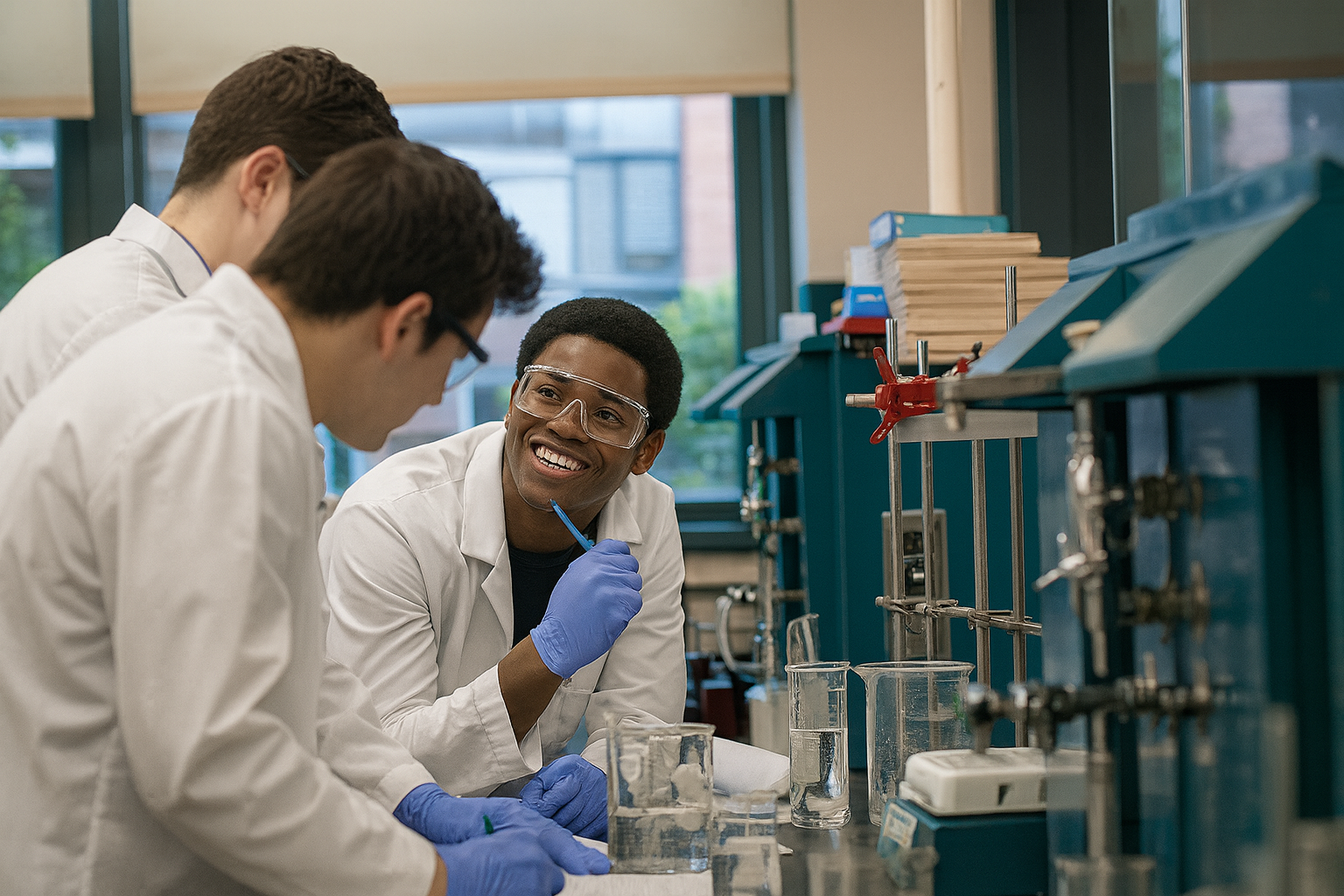

Paint by Numbers: The New Corporate Yardstick

In this inaugural feature of Paint by Numbers—a focus on one or more telling economic charts—I point to a change in how I believe companies will measure productivity and progress: average revenue per employee.

Trump Accounts: A No-Brainer Investment for Children

It may be more like a free snack than a free lunch, but nevertheless, the federal government is essentially gifting money to those citizens born between 2025 – 2028. For parents of children born in these years, it is truly one of the rare no-brainer financial decisions: open a Trump Account!

More than Trustworthy

I think it’s past the time to seek something greater than integrity alone from financial professionals. Trustworthiness is now the baseline, not the end goal. In an industry that has become more transparent, investors can look beyond character alone and look for real value—expertise, communication, alignment of incentives, and the ability to meet their specific needs.

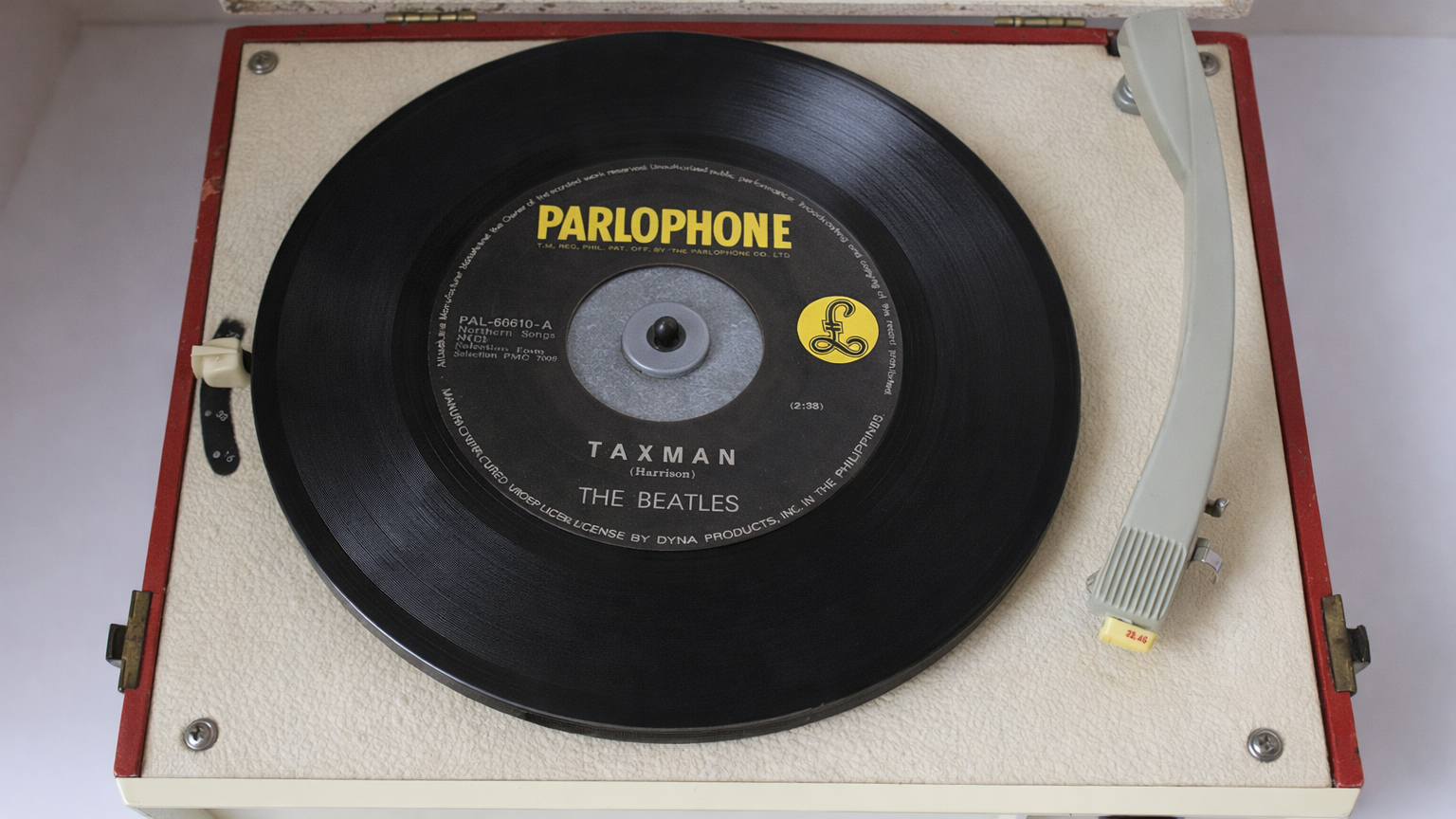

The Best Investment You Can Make

Sometimes the smartest investment you can make has nothing to do with your portfolio …

My Final Post: 6 Things I Learned During My Time at Tableaux Wealth

For my last post at Tableaux Wealth, I spent some time thinking about what topics I wanted to cover. Did I want it to be more about financial advice, financial planning techniques, investing, or just about life in general? Finally, I decided, why not include all of it?

Yes, Markets Are Unpredictable. That’s No Excuse for Standing Still

We can’t know what the future holds, but we know we’ve seen tremendous growth in the last few years, and we know that prices are now revealing a changing mindset. This information is useful in the context of a financial plan.

New Tax Break for Seniors

This year’s tax bill includes what the administration calls “No Tax on Social Security.” It’s not an explicit removal of taxes on Social Security payments, but it does provide an additional deduction for seniors under certain income limits. We explore it here.

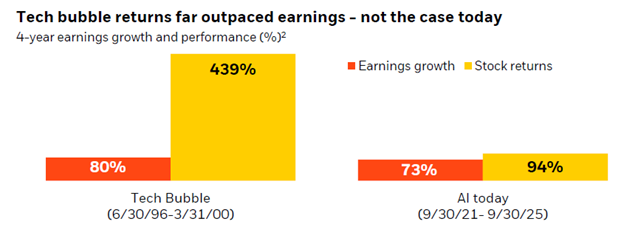

A U.S. Economy Powered by AI

The most asked questions we’ve received from clients of late are: “Is AI in a bubble?” and “What’s your strategy for an AI pullback?” For our part, we take a more measured view based on three key observations of what we know now.

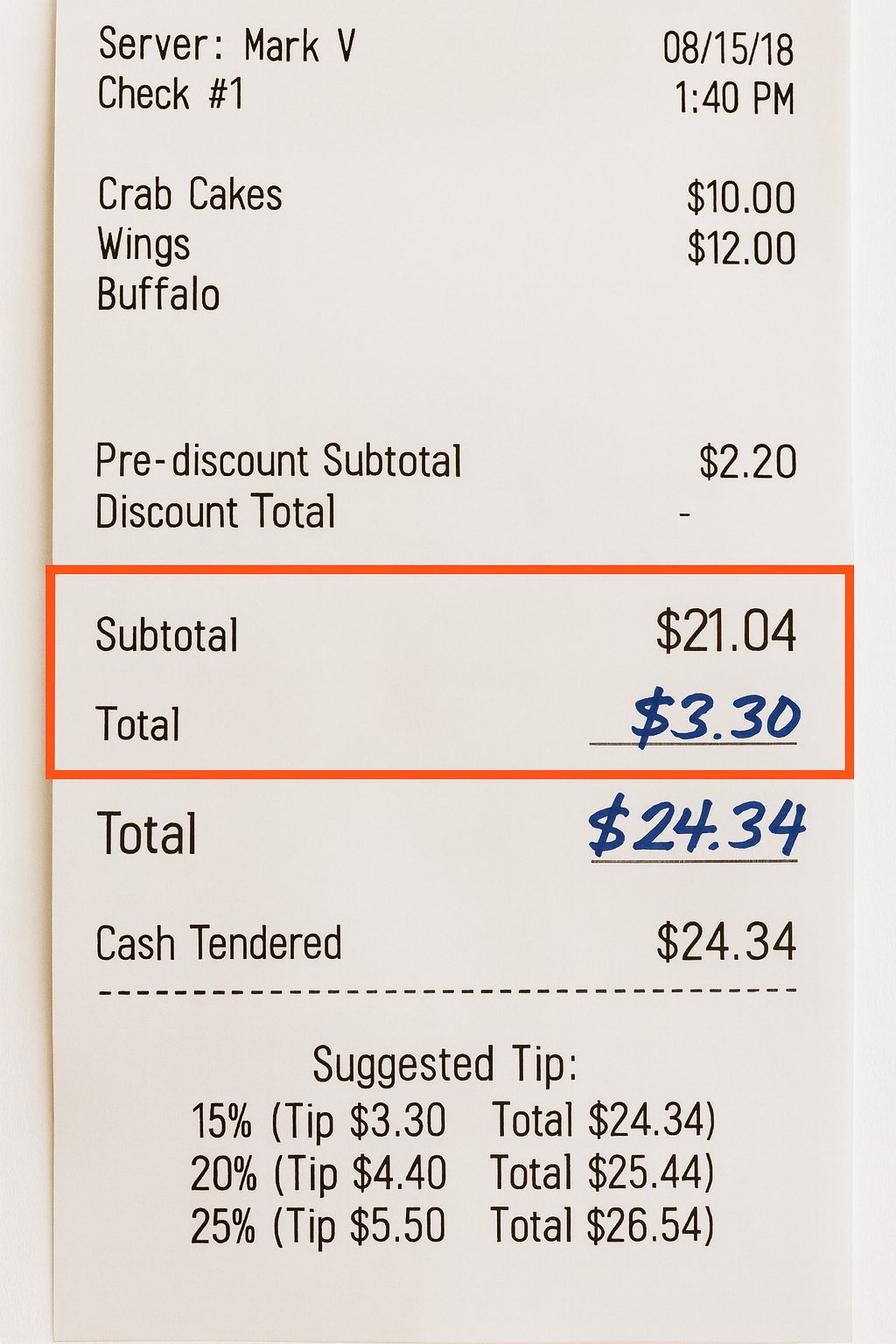

New Rule Could Boost Refunds for Workers

One of the signature provisions in the recently passed tax bill is the so-called “no tax on tips and overtime.” While there are some limitations, this change could deliver meaningful benefits for workers who earn much of their income from tips or overtime pay.

The Grandparent Loophole: 529 Plans Revisited

We’ve noted that 529 plans are often useful even if you don’t have college-bound children. And if you’re a grandparent considering starting a 529 plan, you should be aware of the recent revisions to the Free Application for Federal Student Aid (FAFSA) that went into effect as of the 2024-2025 academic year.

Why Wages, Not COLA, Matter More for Future Retirees

The modest 2026 COLA may barely offset rising Medicare premiums. But for those still in the workforce, rising wages are the real story. Let’s take deeper look at what determines your standard of living in retirement—the AWI or the COLA.

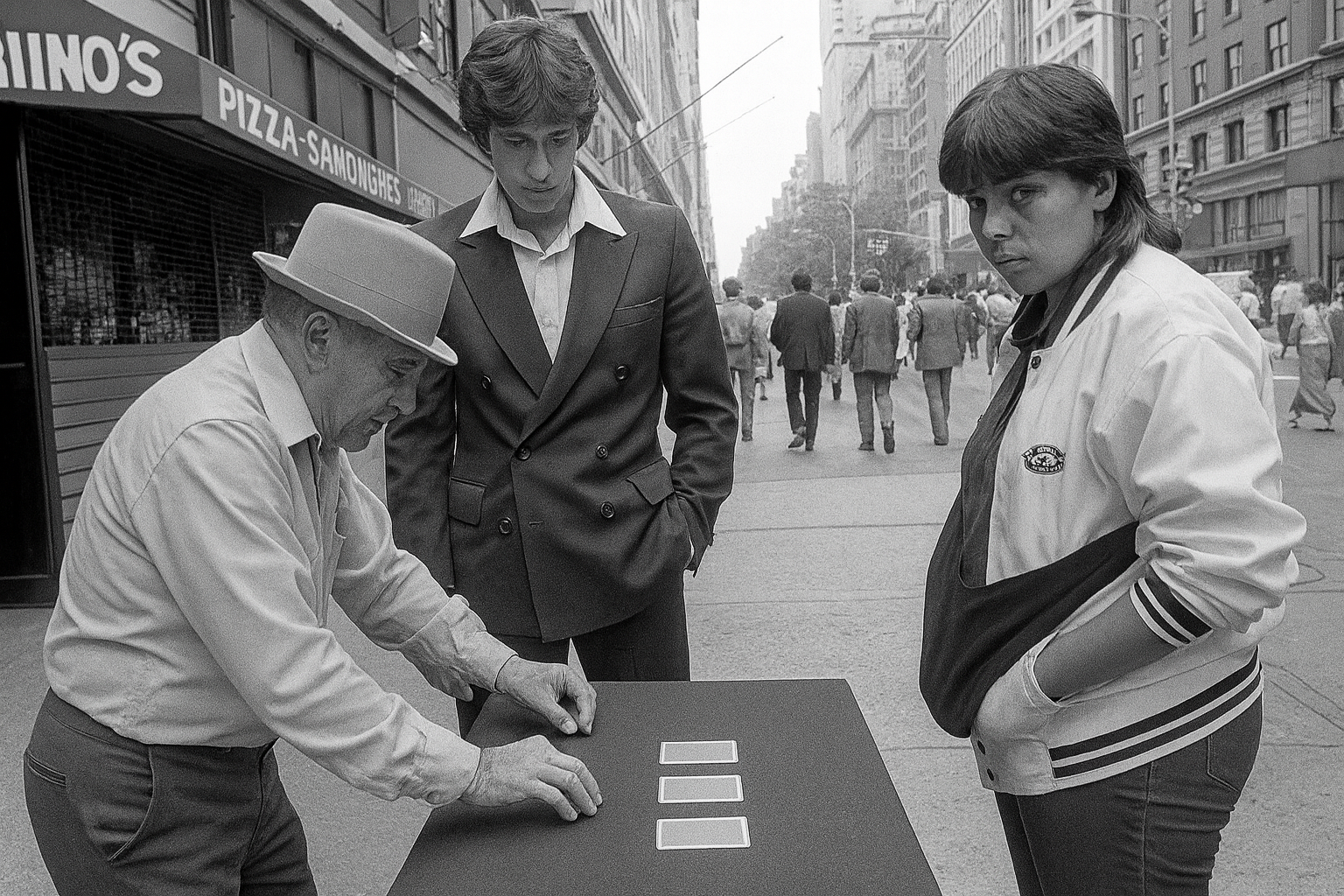

Don’t Fall for These Scams

One unfortunate drawback of our tech-enabled world is that scams are increasingly common. Seniors are often targeted because they have savings and may hesitate to report fraud. According to the National Council on Aging, here are some of the most common scams targeting retirees today.

The Fed, Mortgage Rates, and Home Prices

Do mortgage rates always go down when the Federal Reserve (the “Fed”) cuts interest rates? And even if mortgage rates decline, should we expect home values to rise as a result? To find out, I spoke with Eric Steuernagle, owner of Fairground Real Estate in Great Barrington (MA) and a housing expert.