The Case for Gold, Despite the Recent Pullback

As of the time of this writing, the price of gold has fallen roughly 6% from its all-time high of $4,379 per ounce in October.

Despite this pullback, I’m going to share a few reasons why we believe a positive long-term outlook for gold remains intact.

Growing central bank holdings

One of the reasons for gold’s roughly 56% return year-to-date is an increase in investment by central banks.

For the first time since 1996, gold now represents a larger percentage of foreign reserves than U.S Treasuries:

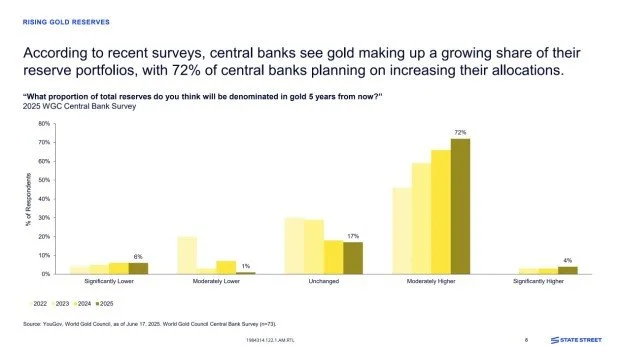

Additionally, in a survey conducted by the World Gold Council this year, 76% of central banks indicated they project the portion of their reserve portfolios allocated to gold will be moderately higher or significantly higher over the next five years:

Continued demand from these institutions could provide a sustainable tailwind for gold prices.

Easing monetary policy and lower real yields

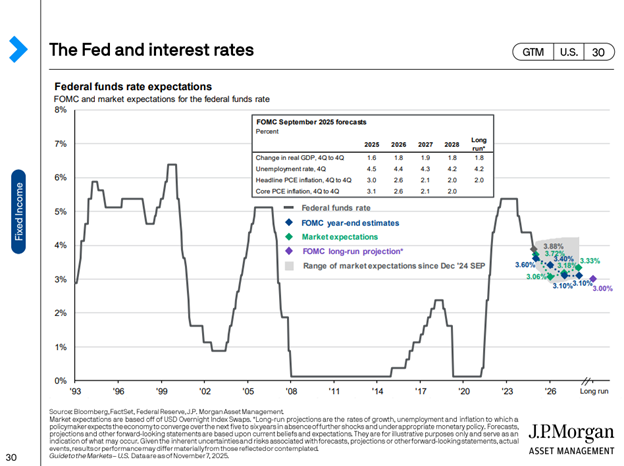

The Federal Reserve’s outlook increasingly points toward an easing of monetary policy, and not a tightening, as both the Federal Open Market Committee (FOMC) and the market predict further rate cuts through 2026:

Continued rate cuts could make for an even more positive environment for gold, for a few reasons:

Cutting rates typically weakens a currency relative to other monetary assets, especially assets with a more fixed supply such as gold.

Gold becomes more attractive when nominal interest rates come down, as it has less competition from yield-bearing assets.

Lower interest rates combined with rising inflation would cause real rates to fall, which has been historically positive for gold prices.

I want to briefly expand on a couple of these points.

The relationship between gold and U.S. dollar strength

The chart below compares gold (priced in U.S. dollars) with the U.S. Dollar Index (DXY) which represents the value of the U.S. dollar relative to a basket of other currencies.

We can see when the DXY weakens (here, when the line goes up, because the DXY chart is inverted), gold’s price rises, and vice versa:

We would expect an easing of monetary policy to generally weaken the dollar, providing a tailwind for gold’s price relative to the U.S. dollar.

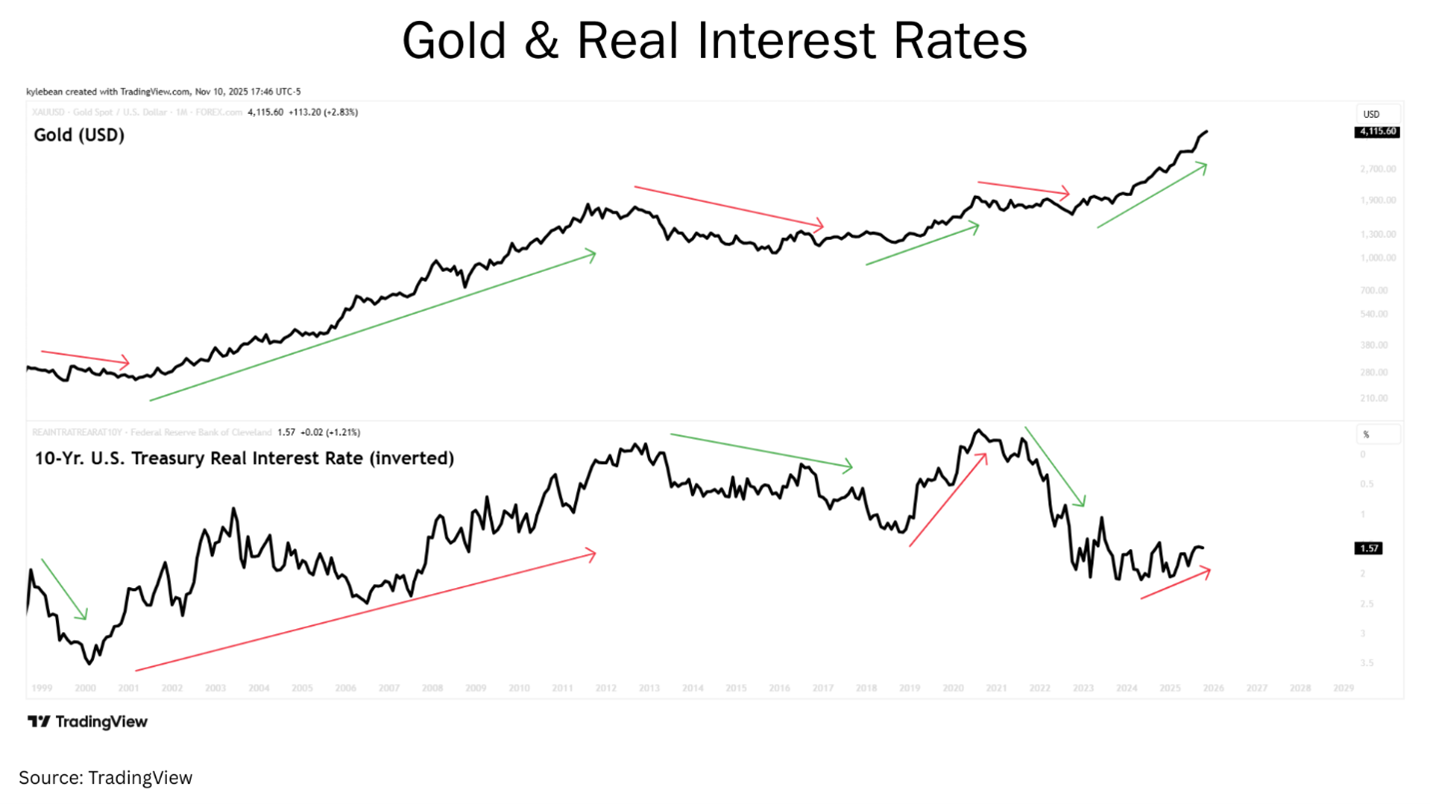

Gold and real interest rates

Real interest rates are the interest rates fixed-income product provides in excess of inflation.

Historically, the price of gold is negatively correlated with real interest rates—when real rates fall, the price of gold rises.

The next chart shows a similar relationship we observed in the previous chart. When real interest rates fall (here, when the bottom line goes up, since the 10-Yr. U.S. Treasury real interest rate plot is inverted), gold’s price rises:

We expect real interest rates to fall, given the expectation of rate cuts by the Fed combined with our outlook that inflationary pressures are building, which I discussed in our last webinar.

This would further suggest a positive environment for gold.

A worthy diversifier

Given the potential outlook for gold, the next question is: Does gold still earn an allocation in portfolios?

We think so.

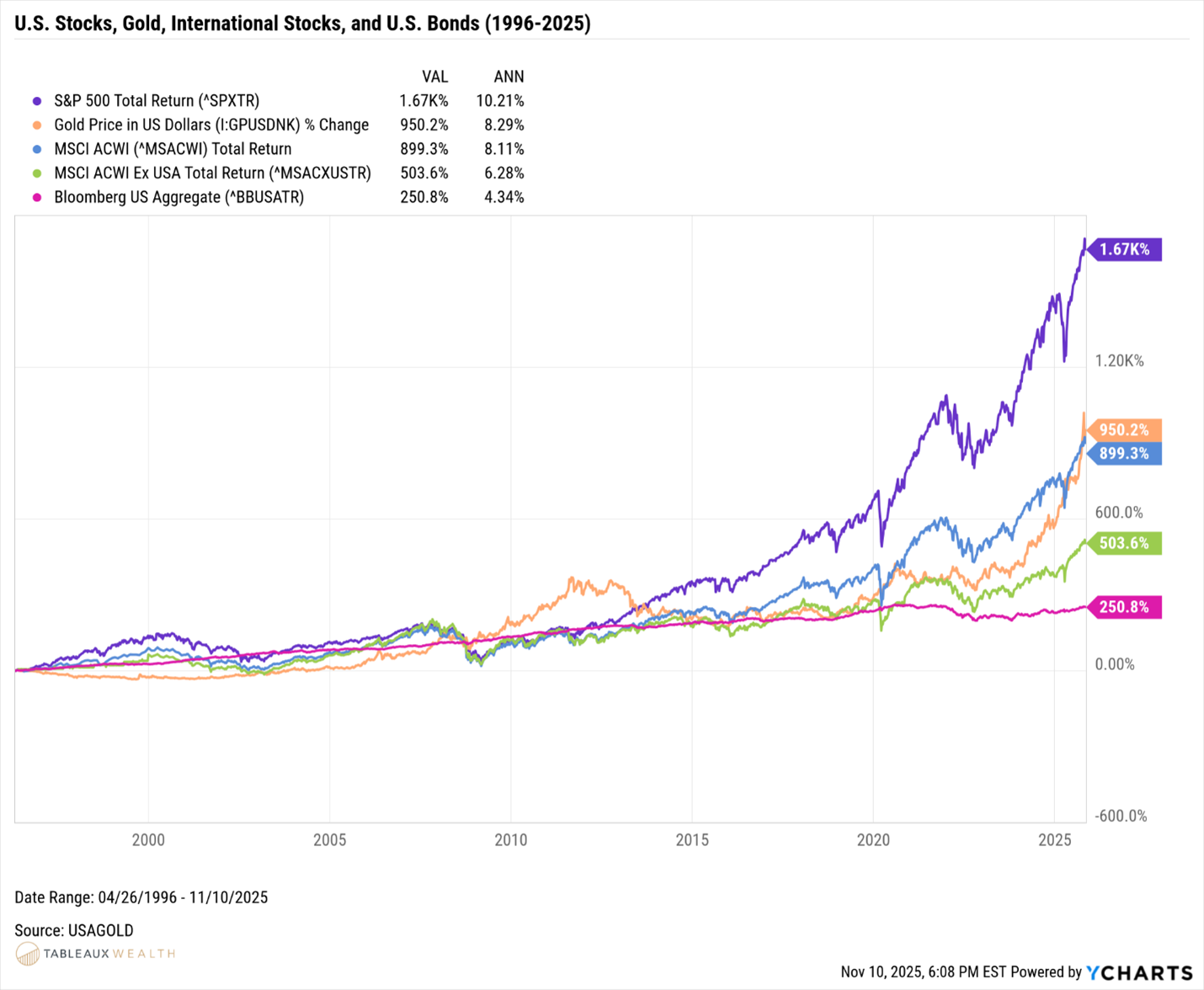

First let’s look at gold compared to other components of a diversified portfolio, mainly stocks and bonds.

In the chart below, from 1996 to today gold underperformed the S&P 500 on a total return basis but outperformed the total returns of global stocks (U.S. and international), international stocks, and U.S. bonds:

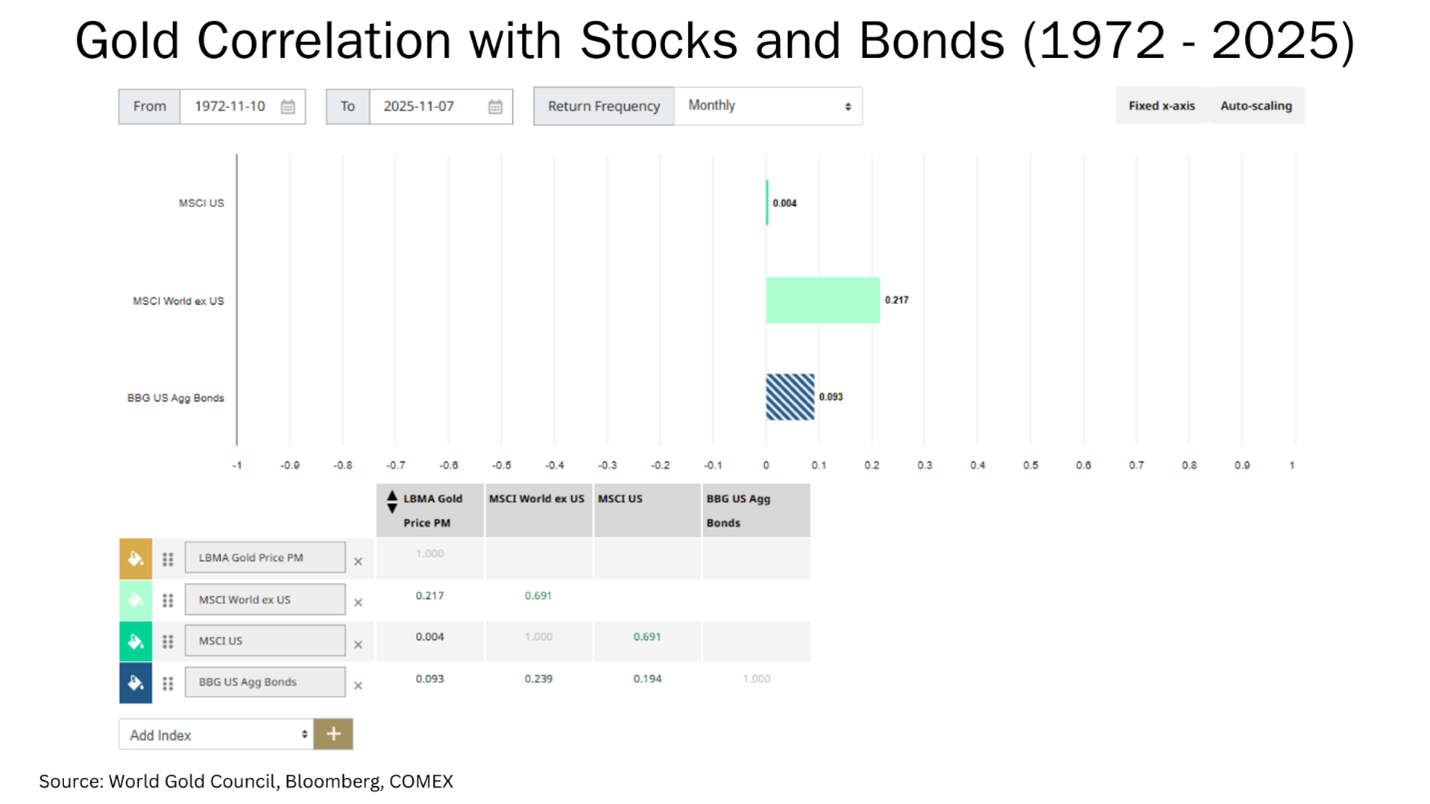

Furthermore, gold returns have a historically low correlation to global stock and U.S. bond returns, meaning that they seldom move in the same direction at the same time, making gold a good diversifier:

Over the timeframes in the chart above, gold provided stock-like returns with a low correlation to both global stocks and U.S. bonds.

For this reason, and given the outlook for gold provided above, we believe gold still deserves a place in portfolios, despite the recent pullback from all-time highs.