Trump Accounts: A No-Brainer Investment for Children

As you may have noticed, we at Tableaux Wealth are a bit obsessed with preaching the benefits of 529 Plans. We were therefore particularly interested in considering the benefits, drawbacks, and distinctive features of the new “Trump Accounts” that will be rolled out this year because they, like 529 Plans, offer the opportunity for preferential tax treatment to benefit our children.

First, what exactly is a Trump Account? Essentially, it is a retirement account for minors, but that isn’t funded by the minor’s earned income. Beginning in 2026, any child with a Social Security number who is under age 18 for the entire calendar year is eligible to open a Trump Account (with his or her parents or guardians as custodians). What’s more, any U.S. citizens born between Jan 1, 2025 and Dec 31, 2028, will be eligible to receive a $1,000 contribution from the federal government as their initial Trump Account nest egg,[1] and that contribution does not count toward the annual limit (explained below).

Contribution limits for Trump Accounts are currently set at $5,000 per account per year, and contributions can be made by individuals, corporations (up to $2,500 per year), charities, or local, state, or federal governments. Notably, governmental bodies and charities are not subject to the $5,000 annual limit. (We will be paying attention to developments in this area, so stay tuned for a possible future Tablet piece on the ramifications of governmental and/or charitable contributions to Trump Accounts). As currently designed, contributions by individuals are made with after-tax dollars, but corporations can make certain contributions with pre-tax dollars.

Once contributed, Trump Account funds must be invested in either low-cost mutual funds or exchange traded funds (ETFs) that track a major index such as the S&P 500. Until age 18, the beneficiary’s money is locked up under almost all circumstances.[2] At age 18, the beneficiary’s account must be rolled over into a traditional IRA, subject to IRA withdrawal rules (i.e., no use restrictions but subject to a 10% withdrawal penalty until age 59 ½).

When the beneficiary reaches retirement age, distributions—including required minimum distributions—will be subject to the pro-rata rule that addresses the mix of 1) after-tax contributions (for which no tax is owed), 2) pre-tax contributions from employers, governmental, and charitable sources, and 3) growth plus earnings. The latter two categories are treated as ordinary income when distributed.

Free Money

It may be more like a free snack than a free lunch, but nevertheless, the federal government is essentially gifting money to those citizens born between 2025 – 2028. For parents of children born in these years, it is truly one of the rare no-brainer financial decisions: open a Trump Account! Even if you never contribute any of your own money, you don’t want to pass up $1,000 that can grow tax-deferred for decades.

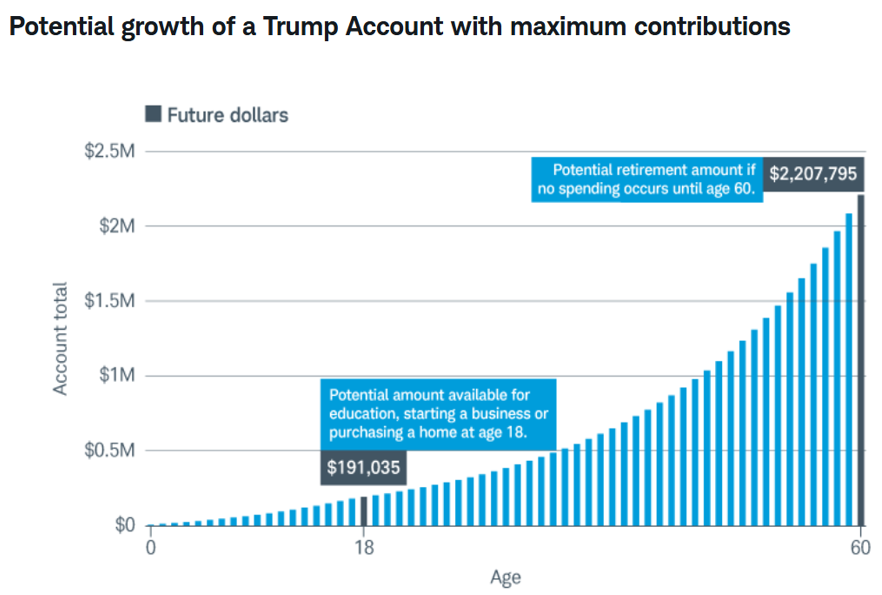

But if you do make consistent annual contributions to such an account, the compounding effects are sizeable. The chart from Schwab below shows the possible growth of a Trump Account that is seeded with $1,000 from the federal government and receives annual parental contributions of $5,000 until age 17, assuming annual inflation of 2.3% and investment growth of 6%.

Additionally, similar to employer retirement plan matches, you shouldn’t pass up employer contributions into your kids’ Trump Accounts if offered. We wouldn’t be surprised if, following in the footsteps of major financial firms like Blackrock and Bank of New York Mellon, employer contributions to Trump Accounts become an increasingly popular perk. For example, Blackrock is currently planning to offer contributions of $1,000 into Trump Accounts of employees’ children—money that is not treated as income to the employee.

Do Trump Accounts Trump Other Accounts?

Do these new accounts equal or surpass the benefits and versatility of 529 Plans? In a word: no. 529 Plans remain superior for a few reasons:

They can be withdrawn and used for education (and are not locked up until retirement)

Withdrawals for qualified education expenses are tax-free from a 529 account, while distributions from a rolled-over Trump Account (IRA) are taxed as ordinary income.

What’s more, for a child who has earned income, a Roth IRA may be a preferred place to park additional funds, as those accounts offer tax-free growth. But if your family has maxed out contributions for 529 Plans and has sufficient funds left over, then parking that extra money into a Trump Account seems to be a very good option. Having more buckets of money from which to draw down the road is generally better than having fewer.

Note: For those eager to open a Trump Account today, you should know that while accounts can technically be opened now along with the requisite IRS election, contributions to Trump Accounts cannot be made until July 4, 2026.

[1] Notice of intent to issue regulations with respect to section 530A Trump accounts

[2] Distributions can be made in the following cases: (1) to be rolled over into another Trump account for the same beneficiary; (2) to be rolled over into an ABLE account in the year the child turns 17; (3) to return excess contributions; or (4) upon the death of the beneficiary.