Market Commentary: Positive Numbers

For this month’s markets commentary, I'd like to touch on two topics: 1) S&P 500 earnings, and 2) a sub-component of labor market data.

An Earnings Surprise

As 2nd-quarter earnings reporting comes to a close, we can begin to assess this earnings season in aggregate and compare it to previous quarters.

The big concern in equities markets earlier this year was how tariff increases would affect companies' earnings, with many fearing a negative impact.

But in the second quarter we saw quite the opposite.

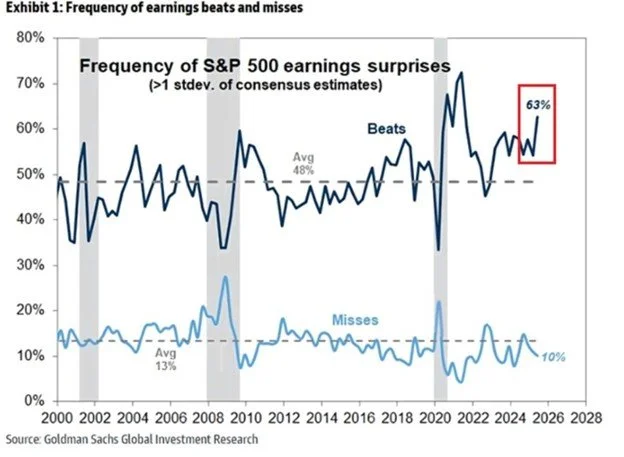

Fully 63% of S&P 500 companies that reported beat expectations by at least one standard deviation—that is, well more than usual). It was the best performance in four years, and far above the long-term average of 48% (see the line chart below).

It was one of the best quarters in the last 25 years, rivaled only by the post-pandemic recovery.

This shows strong earnings momentum.

Source: Goldman Sachs Global Investment Research

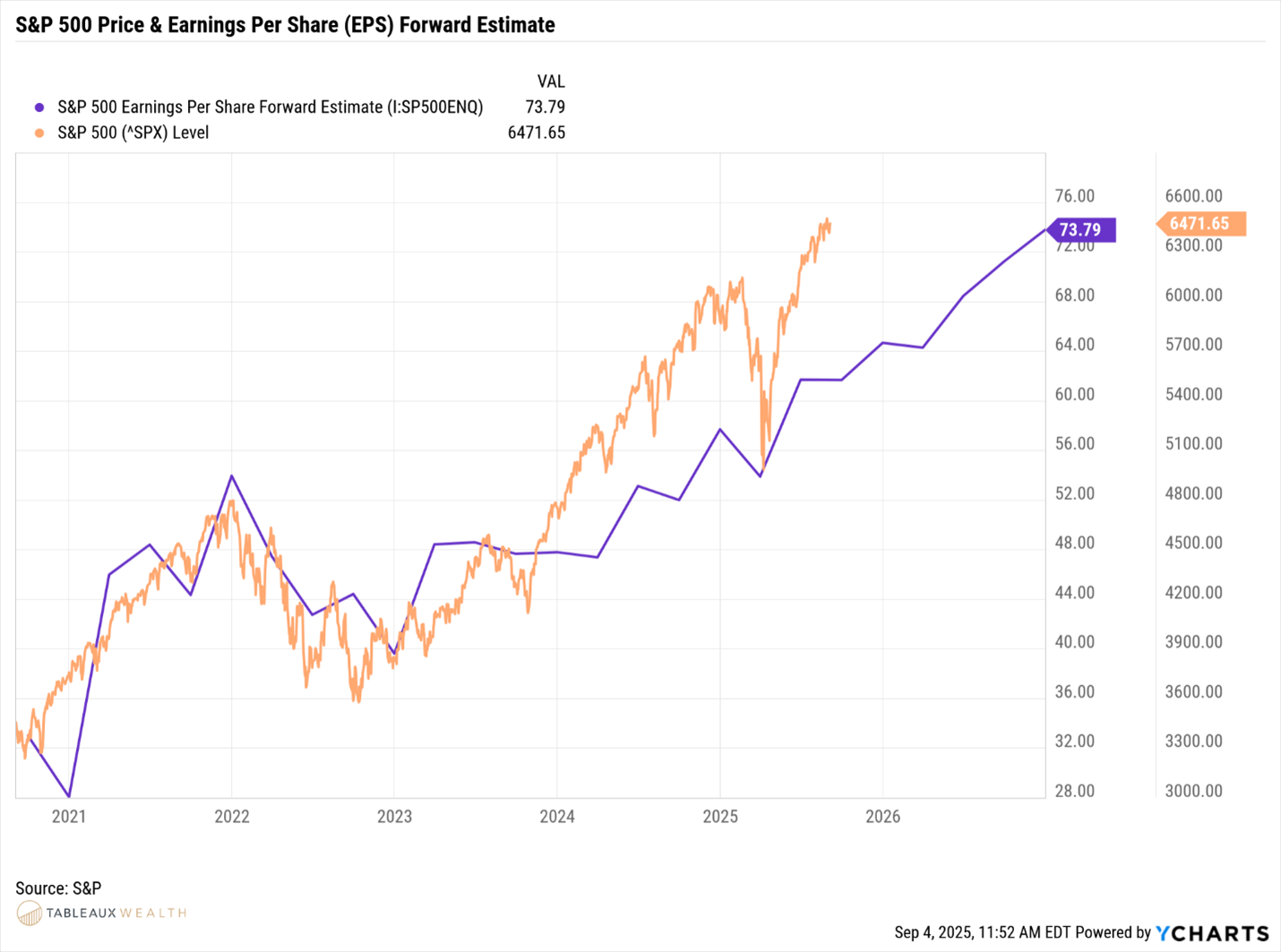

Given that earnings have historically driven equity returns, this further strengthens our positive outlook for equities through year-end and into 2026, a view that is also supported by higher forward earnings per share (EPS) estimates:

A Rebounding Labor Market?

Recent labor market data showing signs of a softening market is contributing to higher expectations that the Federal Reserve will cut the federal funds rate, a key driver of interest rates, at the FOMC meeting this month.

But while some of the lagging headline numbers indicate a deteriorating economy, as we dig into some of the more forward-looking sub-components of the economy, we see signs of recovery.

For example, a rise in year-over-year nonfarm payrolls temporary help services signals that temporary help hiring is increasing:

Source: Real Vision The Macro Investing Tool Business Cycle Update, August 21, 2025

Why is this significant?

Temporary positions are highly cyclical. They are often the first hired and the first fired as businesses expand and contract their workforces.

A climb in year-over-year changes in temporary positions out of negative territory into positive is what you would expect to see in an early-stage recovery in the labor market.

Even as weakening headline numbers are increasing the likelihood of a Fed rate cut this month, we believe we’re already seeing early signs of a recovering labor market, and not a late-stage peaking labor market.

This further strengthens our view that business activity is expanding. And any expansion would be helped further by a Fed rate cut.

All of which raises a very important point about investing: it’s not where you are now but where you are going that matters.