Giving a Lifeline to Charities—and a Tax Benefit to Yourself

You’ve probably heard it: charitable organizations are under increasing financial strain. Inflation has driven up operating costs—especially for food, housing, and staff salaries—while federal, state, and local government grants have shrunk. While most nonprofits expect demand for services to increase, 36% had an operating deficit at the end of 2024—a 10-year high. Many charities now face budget gaps that threaten core programs.

But there’s a way that many retirees can help, while helping themselves: the qualified charitable distribution, or QCD.

Anyone age 70½ or older can donate up to $108,000 (in 2025) directly from a traditional IRA you created or inherited, with a QCD.

But if you’re 73 or older and taking required minimum distributions (RMDs), you really benefit from a QCD. That’s because the amount you give through a QCD counts toward your RMD for that year. For example, if your RMD is $40,000 and you give $20,000 to charity with a QCD, you only need to withdraw another $20,000 to satisfy your RMD.

Giving and Receiving

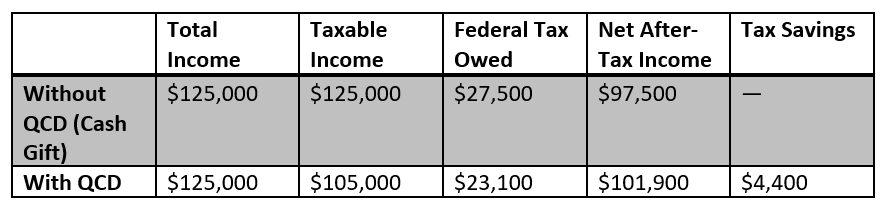

Tax savings for a 74-year-old retiree, $125,000 total income (including RMD), $20,000 charitable gift, 22% federal tax bracket

If you’re under 73, a QCD lowers your future RMDs by shrinking your account balance—a smaller benefit that you may still find worthwhile. Note, however, that a QCD from a Roth IRA doesn’t make sense—since it’s a donation with after-tax dollars, there’s no federal tax benefit. Also remember that a QCD must go to a 501(c)(3) public charity. It can’t go to donor-advised funds, private foundations, or supporting organizations.

We sometimes explain the value of donations in terms of “charitable dollars purchased” after tax savings. For example, for someone in the 24% federal tax bracket, each $1 donated from a taxable account “costs” $0.76 after the deduction. But with a QCD, you give the full $1 without its ever being taxed, which is much more efficient than post-tax giving.

For residents of states that don’t allow charitable deductions from state income tax (for example, Connecticut, New Jersey, and Ohio), a QCD is the only way to get a tax break for charitable giving. For states with no income tax—or Pennsylvania, which does not tax IRA distributions—QCDs can still reduce federal taxes.

Because it’s excluded from your adjusted gross income (AGI), a QCD may also can help you in other ways:

Reducing Medicare IRMAA surcharges

Lowering the threshold for deducting medical expenses

Helping you avoid the 3.8% Net Investment Income Tax

Keeping more of your Social Security benefits tax-free

A One-Time Opportunity

Under current law (SECURE 2.0, 2023), a one-time QCD of up to $50,000 can be directed to certain “split-interest” entities such as a charitable remainder trust (CRT) or a charitable gift annuity (CGA). This can provide you (or another beneficiary) with income for life, with the remainder going to charity. This option still counts toward your annual QCD limit (currently $108,000) for the tax year.

Timing Your QCD

Because any IRA withdrawals count toward your RMD before QCDs, timing matters. Make your QCD before making other IRA withdrawals for the year. DeMuth’s rule of thumb: take QCDs in January and leave the rest of your RMD until December, extending the time your RMD amount can grow tax-deferred.

Watch the Details

As with many powerful tax-planning strategies, QCDs have rules and nuances. Special provisions apply to SEP and SIMPLE IRAs, IRAs with after-tax contributions, and accounts receiving contributions after age 70½. Some states (including Arizona and Ohio) offer state tax credits for certain charitable gifts, potentially layering benefits, although rules can be complex.

Before making a QCD, consult your Tableaux Wealth advisor and CPA. Together, we can assess whether a QCD aligns with your broader retirement, tax, and charitable goals—and all the technical requirements—so you get the full benefit.