Creating a Nest Egg Before Leaving the Roost

Just about everyone nowadays is aware of the need to save money for retirement. Pensions are few and far between, and Social Security, while a great income supplement, is insufficient on its own. We have all learned that the sooner in your career you start investing for retirement, the better. But what’s better still? Saving money before even beginning a career.

Ways to Help Your Children Save

In recent Insights we’ve discussed in detail two ways to help save for your children’s future, but they deserve mention again. First, 529 Plans. While these are not retirement accounts, it’s plain that the more money your child has to pay for college, the less your child will owe in student loans after college—and the sooner she can afford to start investing a portion of each paycheck into a retirement plan.

Investing in a 529 Plan provides an opportunity for money to grow and be available for educational expenses, tax-free. Saving in a 529 account can begin at any time, even before your child’s birth,[1] and is a great first step in saving for the future.

A second option you can begin as soon as your child has a Social Security number is investing in a Trump Account. Starting July 2026, you can contribute up to $5,000 each year into your child’s Trump Account, subject to certain exceptions and restrictions. (For more details, see our recent post [link to last tablet article]). These accounts will operate like a retirement account but without requiring earned income from the child.

Invested funds grow tax-deferred, and at age 18 those funds can continue to grow tax-deferred after being rolled over into a traditional IRA. Additionally, any U.S. citizens born between January 1, 2025 and December 31, 2028 will be eligible to receive a $1,000 contribution from the federal government as their initial Trump Account nest egg,[2] and that contribution will not count toward the $5,000 annual limit.

Another Way to Save: Custodial Roth IRAs

These first two ways of helping children essentially require parents to make gifts to their children in tax-preferential ways. But when a child reaches age 14 (or earlier, if the child has earned income from a reportable source) parents can open a custodial Roth IRA. These accounts can be used to invest a portion of a child’s earnings from, say, a summer job. They work just like a Roth IRA: after-tax money (up to $7,500 a year in 2026) is invested, grows tax-free, and can be distributed in retirement tax-free.

Unlike a traditional Roth IRA, a custodial Roth IRA is opened and managed by a parent or guardian until the child reaches 18. Parents also have the option of contributing funds into their child’s account (whether or not the child contributed), up to the amount of the child’s earned income or $7,500, whichever is less.

By allowing parents to contribute to their children’s account, custodial Roth IRAs provide flexibility and let parents create incentives for their children to save—for example, by offering to match your child’s own contributions up to a given amount, say, $3,000.[3]

Moreover, not only are custodial Roth IRAs a great vehicle for investing early for retirement investment, but in nearly every case children will never be in a lower tax bracket in their lives, which makes childhood a great time to begin investing after-tax money.[4]. And thanks to the standard deduction ($16,100 in 2026), unless your kid has a very lucrative gig, it’s likely no income tax will be due on that earned money.

More Ways for Business Owners

For the approximate 13 to 14 percent of U.S. families[5] that are small business owners, there are additional ways to boost savings. First and most obvious, owning a family business provides the opportunity to employ your children (depending, of course, on the nature of the work). You can pay your child for legitimate office work as you would any other employee, provided the necessary work permits are obtained, your state’s minimum age rules are followed, the salary is reasonable for the work done, and the child is included in your company payroll[6].

Officially employing your child (as opposed to paying your child under the table) requires complying with all state and federal payroll requirements, which include collecting employee FICA withholdings of 7.65 percent (6.2 percent for Social Security up to the annual wage base limit and 1.45 percent for Medicare) and paying the employer’s 7.65 percent FICA tax, Federal Unemployment Tax (FUTA, which is 6 percent on the first $7,000 of wages per employee), and State Unemployment Tax (which varies by state and industry and which can be partially credited against FUTA)[i].

If you own your business as a sole proprietor, or as a partnership or LLC with your spouse, there are tax advantages to hiring your minor children. In those circumstances, your child’s wages are exempt from Social Security, Medicare, FUTA, and many state unemployment taxes, including Massachusetts.[7]

And if your child is under 21 and works for your family business, his wages are exempt from FUTA taxes. That can be a significant savings for your business while benefitting your child’s pocketbook. Furthermore, although a child’s wages are not exempt from income tax, thanks to the current $16,100 standard deduction a significant chunk if not all of a child’s occasional or part-time wages will not result in any tax owed.

If you own your own business, you can also have the business contribute up to $2,500 of pre-tax money into Trump Accounts for each of your children, regardless of their age or work status. This has the double benefit of reducing taxes owed by the business while growing your children’s nest eggs. In such cases, you have the option of investing another $2,500 of post-tax personal money into your children’s Trump Accounts to reach the $5,000 annual limit.

Put the Power of Compounding to Work for Your Kids

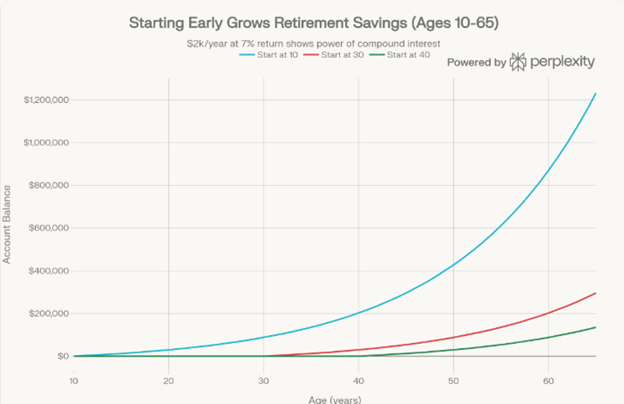

Whatever method you use, the earlier you can help your child begin to save, even in modest amounts, the lighter your child’s retirement savings burden. The chart below starkly illustrates how starting early leverages the power of compounding interest, by comparing $2,000 annual contributions beginning at ages 10, 30, and 40.

If you can make it happen, there may be no better gift you can give your child.

The power of compounding over time favors those who save early

[1] This can be done with either a beneficiary change after birth or a rollover from an existing 529 account into a new 529 account.

[2] Notice of intent to issue regulations with respect to section 530A Trump accounts

[3] Note that any such contribution by a parent would count toward the annual gift tax exclusion.

[4] Custodial Roth IRA: Roth IRAs for Children - NerdWallet

[5] The Financial Security of Small Business Owners: Evidence from the Making Ends Meet Survey | Consumer Financial Protection Bureau

[6] Massachusetts Minimum Age Requirements & Child Labor Laws - WorkforceHub

[7] Family employees | Internal Revenue Service; Employer contributions to unemployment | Mass.gov

[i] Topic no. 759, Form 940, Employers Annual Federal Unemployment (FUTA) Tax Return – filing and deposit requirements | Internal Revenue Service