Wealth Planning with Artificial Intelligence

Artificial intelligence (AI) isn’t exactly new, and even ChatGPT is almost three years old. But AI is still grabbing headlines.

My colleague Kyle Bean was struck at the recent JP Morgan Wealth Management Summit that the talk wasn’t about tariffs, interest rates, or the U.S. dollar. It was about AI.

That discussion was how AI is affecting investments and investing. But what about the effect AI is having on wealth planning—both in the services we provide to you and how we run our businesses, which directly affects you?

There are many kinds of AI. You may be using them without realizing it. Netflix’s recommendations use AI models, as do Siri and Alexa. Or you may have used ChatGPT, Microsoft Copilot, Claude, or another “chatbot” that responds to questions and commands with human-sounding text or images.

Advisors are using AI, too.

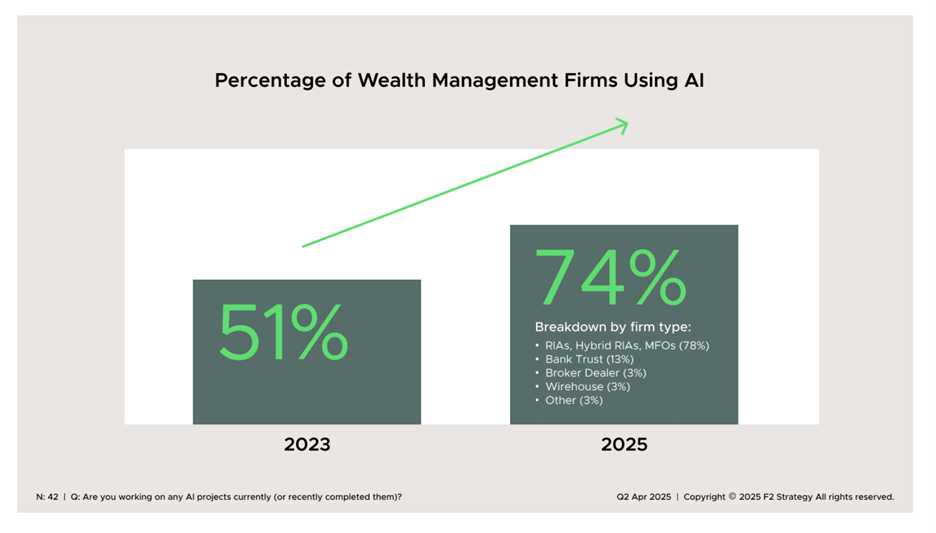

According an April 2025 survey by F2 Strategy, the number of wealth management firms using AI jumped from 51% in 2023 to 74% in 2025. The biggest adopters were RIAs like Tableaux Wealth, while advisors at banks and traditional brokerage firms were far less likely to use AI.

Smaller advisory firms tend to get their AI technology through products and services provided by vendors, according to the report, and larger firms—think Fidelity and Morgan Stanley—tend to build AI solutions in-house.

AI is helping advisors prepare for client meetings, take meeting notes, and send client communications more quickly, the report notes. Some firms are using optical character recognition to process forms and data. Chatbots such as ChatGPT and Claude have been a boon to programmers, who can code much faster, benefitting larger firms with in-house software development teams, the study found. Some survey respondents even reported using software that provides estate and tax planning with AI-assisted tools.

At Tableaux Wealth, we’ve experimented with AI since the introduction of ChatGPT in late 2023.

We find that AI can be a huge time-saver for certain things. Like providing the first draft synopsis of our 100-plus-page investment committee presentation. Or offering immediate expert advice on the best time to send our educational newsletter to clients. It helps us get more done in a day.

Not exactly revolutionary. But there’s a good argument that in the next decade or sooner, investors with less than $500,000 or so in investable assets—the vast majority of people—will get their investment advice through AI. That’s because their financial challenges are relatively straightforward and tend not to include complicated tax and estate planning or charitable giving tactics. That would be a major change.

So would relying on AI in any significant way in what’s called “the investment process”—identifying stocks, bonds, and other securities to buy or sell. Neither AI nor the investment management industry are quite ready for this, although the question is not if but when. I would expect this to happen at large institutions first, made available in some recognizable format (an ETF or separately-managed account, for example).

How does all of this affect you? I expect that most advisors will redirect any time and cost efficiencies to providing clients with more comprehensive services. Michael Kitces, an expert on the advisor industry, notes that as advisors become more efficient, whether by adopting technology or hiring more staff, they tend to “go deeper” with clients—using that found time “to do more for the same client, rather than doing the same in less time.”

The prediction that makes the most sense to me is that, together with our clients, the advisory industry will find the boundary between what AI does well and what skilled, experienced humans do well.

With AI, that border is beginning to shift, and someday could be re-drawn to include tasks requiring far more intelligence and expertise than even today’s highly skilled investor possesses.