Fourth-Quarter 2025 Report

We're pleased to share with you our fourth-quarter 2025 report--a summary of our investment decisions and results in 2025 and our outlook for 2026.

Levels of risk management

Risk is always top of mind for us as we think about managing portfolios, but in this update, we wanted to discuss one principle of how we implement risk management in your portfolios. Poker players will be familiar with the idea of “sizing your bets.” In essence, the idea is to take measured bets based on current conditions. This is how we view portfolio decisions. We actively manage risk in portfolios with measured, incremental changes. Even when we feel confident in an investment theme, we never put all our eggs in one basket. We’ve discussed below some of our recent portfolio decisions and how they played out in 2025.

The first line of defense in risk management, however, comes from financial planning. We endeavor to create financial security through a safety net including cash, bonds, or CDs that will cover emergencies and expenses in the next several years. This process is best accomplished when we have a thorough understanding of your circumstances and objectives, which is where we always prefer to begin with clients. We welcome you to contact your advisor whether you want to build a financial plan, update a plan, or simply review the existing plan in the new year.

Looking back at portfolio decisions

Year-end is an opportunity for us to reflect on recent narratives and how we responded in portfolios. Not every decision we make will be perfect, but it’s important to evaluate our decision-making process and learn for the future. We’re happy to say that the good outweighed the bad in 2025, but that doesn’t mean we can’t learn and improve. Here are a few of the major themes and how we responded.

Currency “debasement:” There has been a long-term trend toward greater global liquidity as governments run large deficits and central banks expand money supply. This has the potential to erode the purchasing power of fiat currencies, such as the U.S. dollar. The debasement trade looks to other stores of value that have a fixed supply, such as gold and Bitcoin.

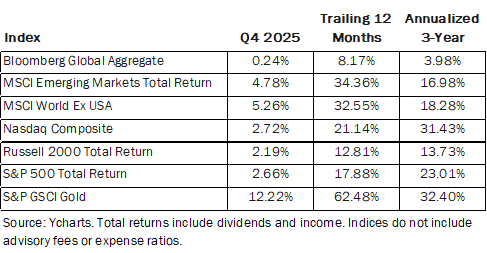

In response, we took a gold position in model portfolios in late 2024. We increased our allocation to gold in early 2025 when it looked like investors were seeking investments beyond stocks and bonds. We added a position in silver in early October, as we thought silver might provide a tactical “catch up” to the rising gold price. These decisions added significantly to model portfolio performance. For the year, gold was up more than 60 percent. Silver was up more than 50 percent in just the last three months of the year, a pace of growth that was much faster than even our most optimistic outlook.

A weakening dollar: The U.S. dollar declined by nearly 10 percent relative to other major currencies in 2025. To capitalize on this trend, we increased our allocation to international stocks in model portfolios. Our primary developed market stock fund (FENI) was up 37 percent for the year, while our primary emerging markets fund (FRDM) was up 61 percent (far outpacing its benchmark).

Tech is the future: Our long-term strategic position has been overweight technology stocks. Our primary tech ETF (IYW) was up more than 25 percent for the year while our primary broad stock market ETF (SPYM) was up almost 18 percent. We added a tech ETF (JTEK) to our model portfolios late in the year but it underperformed the broader tech index. We will continue to watch its performance.

Tariff tantrum: Large and seemingly arbitrary tariffs were announced on dozens of U.S. trading partners in the spring. Amid this development, the U.S. stock market fell by nearly 20 percent. The market decline saw the S&P 500 fall below its long-term moving average, driven by a narrative that tariffs could lead to a global recession. During this turmoil we entered a buffered ETF position meant to provide a downside buffer should the market continue to decline. As it turned out, the market bounced higher and this risk-managed position was unnecessary. While these buffered ETFs showed positive returns, they underperformed the broader market ETFs during this period.

A flattish yield curve: Long-term bond yields have been only slightly higher than short-term bond yields. We like short-term bonds because they are less sensitive to interest rate changes and inflation. As such, we have kept our model bond portfolios relatively short-term. But yields on longer-term bonds declined modestly throughout the year, meaning that longer-term bond returns slightly outpaced shorter-term bonds during the year.

Looking ahead

With 2025 in the rearview, we now look to the themes that are developing in the year ahead. Narratives will inevitably shift throughout the year and we will stay abreast of current conditions. Responsiveness to changes will be more important than predicting the future.

Continued economic growth: Recent GDP figures showed higher-than-expected growth. An expectation of continued economic growth is our baseline assumption.

We’re three years into the current bull market and most market analysts are predicting another year of gains in the stock market. That would not be unusual—an average bull market often lasts four or five years, albeit with a huge range of outcomes. If we’re going to guess which way markets are headed, history suggests positive is more likely than negative. But the longer the bull market runs, the more cautious we become. Heading into the year we remain slightly overweight stocks in model portfolios, but we will keep a close eye on unemployment and market prices. Market prices themselves are often the first indicator of economic weakness.

Market broadening: The Magnificent 7 has contributed massively to the market rally in the last three years. But the fourth quarter of 2025 saw a broadening of the market rally. The S&P 500 equal-weight index and the S&P 500 ex-tech hit all-time highs in December. Even as we maintain our strategic overweight toward technology and growth, we will look for opportunities in more value-oriented funds if this new trend persists.

The AI story: Perhaps the biggest story in 2026 will again be whether AI can continue pushing markets to new heights. We saw a multi-week pullback in many AI-themed names in November as questions swirled about whether AI was a “bubble.” That fear seems to have dissipated as a mild setback, but we will continue watching this story to see how it affects the economy and markets.

New Technology Option

At Tableaux Wealth, we are always trying to improve our technological efficiency and processes and, thus, demo numerous software programs and platforms whenever possible. In so doing, we’ve added another portal through which you can view portfolio performance. The Orion portal is not a necessity for everyone, and many of us are already inundated with data and information. But for those of you who want to see performance on a more granular, daily basis, we will happily switch on this portal for your use. Please contact Shelley if you’d like to explore this new reporting feature.

Our quarterly Tableaux Market Picture webinar was held on Thursday, January 15. Here's a link to the recording. We hosted this webinar virtually, and we were pleased to have several clients attend in person at our Great Barrington office. Consider this your open invitation to attend any upcoming quarterly Market Picture updates in person at 80 Maple Avenue, Great Barrington MA.