Effective Portfolio Management: The Importance of Adaptability

It’s important to listen to the story the market is telling.

Global markets are dynamic, and current narratives can rapidly become old ones.

Beyond simply listening to the markets, a key tenet of effective portfolio management is understanding when a narrative has changed and having the adaptability and agility to implement portfolio changes accordingly.

In the course of my market research, I came across a newsletter that I believe provides a timely example. It's worth sharing.

In Weekly Asset Allocation: Week of 6/16/2025 Jurrien Timmer, director of global macro at Fidelity Investments, shared this on one recently evolving narrative in the markets:

“Wherever you go, there you are” is an old saying that reminds us that there is no escape from our reality, no matter how much we try. It’s an apt metaphor for price discovery: no matter how much work we do to come up with that perfect investment thesis, that thesis could change tomorrow and we need to be mentally adaptive enough to go with that flow. As a road warrior, it’s a bit like rolling with the punches when flights get delayed or cancelled. The sooner we accept change instead of fighting, the more at peace we are.

What I like so much about it is its emphasis on adapting to change rather than fighting it.

It highlights two important aspects of investing: 1) constant monitoring and testing of a thesis, and 2) when there’s a change, being willing to adapt without prejudice or emotion.

Timmer continues:

As most technicians know, what doesn’t happen in reaction to news is often more telling than what does happen. When a market is supposed to react a certain way but doesn’t, something is going on. Case in point was Friday’s news out of the Middle East. When geopolitical events flare up, typically equities will go risk-off, gold will rally, bond yields will fall, and the dollar will go bid.

But only the first two happened on Friday. Bonds were “unch’d” and the dollar index (DXY) made a new cycle low. This is now the second time that this has happened this year, the first being the reaction to “Liberation Day” in early April.

Something is going on, and in my view an important regime change is underway in which Treasuries and the dollar no longer provide the role as global safe haven for risk markets.

The geopolitical event Timmer refers to is the escalation in the conflict between Israel and Iran.

Historically, when an event like this occurred, we typically saw “risk-off” moves in markets—a sell-off in riskier assets like stocks and crypto, a buying up and rising price of gold, a decline in Treasury bond yields (as new money enters the bond market and buyers outpace the sellers, bond prices rise, causing bond yields to fall), and a strengthening U.S. dollar relative to other currencies.

As Timmer points out, we did see a temporary selloff in risk assets and a rally in gold.

What we did not see was money flowing to Treasuries or to the dollar. Treasury rates did not change, and dollar fell.

This raises two questions: 1) are Treasuries and the U.S. dollars still safe havens? And 2) where did the value created by this risk-off selling go?

Timmer’s next observation may be surprising:

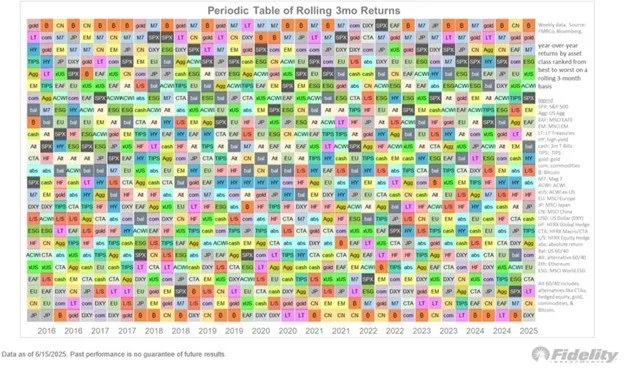

The leaderboard below (which shows rolling 3-month returns using weekly data) tells the story: Bitcoin, gold, Mag7, and global equities on top, and the dollar and Treasuries at the bottom.

The graphic above, which he used to illustrate this point, is often referred to as a quilt chart.

It’s a data visualization used to compare returns of different asset types over a specified period.

This quilt chart shows risk-adjusted returns1 for various assets over rolling three-month periods. At the bottom (the worst-performing assets) were long-term Treasuries and U.S. dollars, which are traditionally risk-off safe havens, performing well when investors are dialing back risk. And at the top (the best-performing assets) are Bitcoin, gold, mega-cap technology stocks, and global stocks, many of which traditionally have been considered risk-on assets, performing poorly as investors flee risk.

Take a moment to digest what this chart is suggesting.

Over the last three-months—during which time there were two historic events: a global trade shock, and kinetic operations by Israel on Iran’s nuclear and military targets, leading to back-and-forth retaliation—Bitcoin, gold, and stocks outperformed U.S. Treasuries and dollars.

Contrary to the conventional narrative, these risk-off events resulted in what would typically be considered risk-on market movements.

There is an old saying in finance and economics: “this time is different.”

It’s an ironic observation that people who assume things are different are demonstrating hubris. It’s a warning that suggests things are never “different” this time.

This saying never resonated with me.

I much prefer the saying, “the only constant is change,” attributed to the Greek philosopher Heraclitus.

As I’ve said, markets are dynamic and subject to change.

Rather than assume things won’t be different this time, I prefer to continue being a student of the markets, challenge old theses, ask if something has fundamentally changed—and be willing and ready to adapt.

[1] Specifically, the chart shows Sortino ratios, which adjust returns by the standard deviation of downside risk.